Frequently Asked Questions

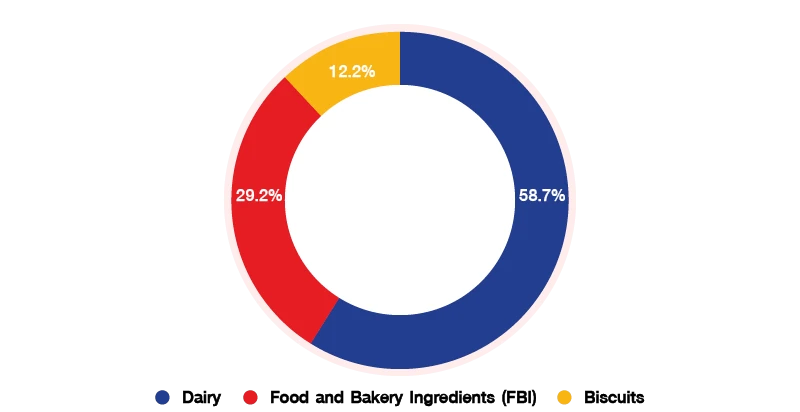

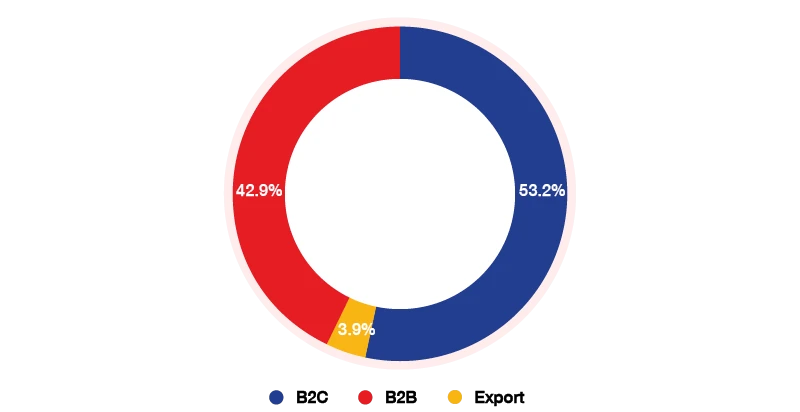

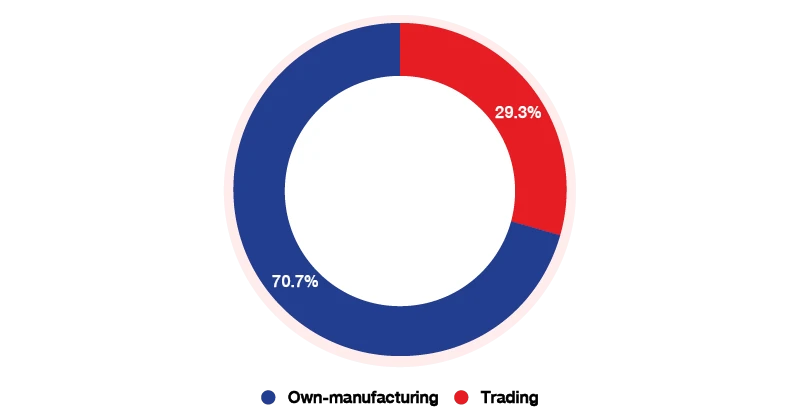

Answer The Company's 2025 sales by product category, by sales channel, and by operation are as follows:

Answer In 2025, the cost of raw materials accounted for approximately 51.0% of the Company's total cost of goods sold (COGS). The Company’s main raw materials include butter oil/ Anhydrous Milk Fat, cheeses, palm oil, wheat flour, powdered milk, sugar, etc.

In 2025, average cost of raw materials increased by approximately 6% compared to the same period last year. The average cost of raw materials rose during the second half of 2024, then began to stabilize from early 2025 through the end of 2025.

The Company completed the butter production line revamp and capacity expansion in mid-December 2025, resulting in enhanced production efficiency and increased butter production capacity from 18,596 tons to 23,261 tons per annum. In 2026, the Company plans to invest in projects aimed at continuously improving production efficiency and reducing production costs. These initiatives include increased implementation of automation systems, such as automated conveyor systems and robotic palletizers, as well as the installation of heat conservation systems and additional solar rooftops. These projects are expected to enhance production efficiency, reduce operating costs, and improve the Company’s profit margins in the future.

Answer Butter Oil is one of the Company’s main raw materials, which accounted for approximately 14.1% of the Company’s 2025 total cost of goods sold (COGS). AMF prices declined toward the end of 2025 due to temporary oversupply in Europe and the US, while buyers were not in a rush to purchase. The significant drop in AMF prices is considered temporary and is not expected to persist in the long term. Meanwhile, the pricing typically has a lead time of approximately 3-4 months, meaning it will become the Company’s cost base over the following 3-4 months. Accordingly, the Company is expected to benefit from lower prices, in line with other producers, around Q2/2026.

Answer The Company’s %SG&A to Sales ratio in 2025 decreased noticeably compared to 2025, driven by strong sales growth, improved operational efficiency, effective cost management, and the full utilization of the KCG Logistics Park distribution center and solar rooftops since the end of 2024. The Company is committed to continuously improving operational efficiency and expense management in 2026 across the entire supply chain through the adoption of digital technologies to enhance the accuracy of sales forecasting, inventory management, and workforce planning and management. These initiatives will enable the Company to effectively control and manage operating expenses on an ongoing basis.

Answer The Company purchases in foreign currencies approximately 50% of COGS. However, the Company meticulously manages exchange rates and hedges the foreign exchange rates by buying forward contracts. The Company also has a foreign currency deposit account (Foreign Currency Deposit or FCD), which will help reduce the impact of exchange rate fluctuations.

Answer The Company has strong and well-known products that have been trusted by consumers for a long time. The Company also has a flexible value chain, allowing the Company to create new products for customers and promptly meet customer needs from the following components.

- Production plants certified by international standards for food industry quality and standards, such as GHP (Good Hygiene Practice), HACCP, ISO9001: 2015, Halal and Hal-Q.

- Various distribution channels throughout Thailand, including Business-to-Business (B2B), Business-to-Customer (B2C), online, and exports to 15 countries.

- Efficient logistics including temperature-controlled transportation, which is very important to maintain the freshness and quality of the products.

- Innovation excellence under KCG Excellence Center, which focuses on research, development, and innovation for new product development. The Company is also fully equipped with laboratory, equipment, technology, and personnel such as the RDI (Research Development and Innovation)/ Professional Chefs of the Company that help develop delightful recipes/ Sales and marketing that understand customer needs, which enhances the Company to quickly respond to the needs of both B2C and B2B customers, supported by the Company’s ability to create new menus that keeps up with consumer trends that change quickly, ability to provide solutions to B2B customers starting from creating menu, developing specific formulas for each customer, adjusting the production formulation, controlling production quality in the commercial scale, and efficiently managing the optimal production costs.

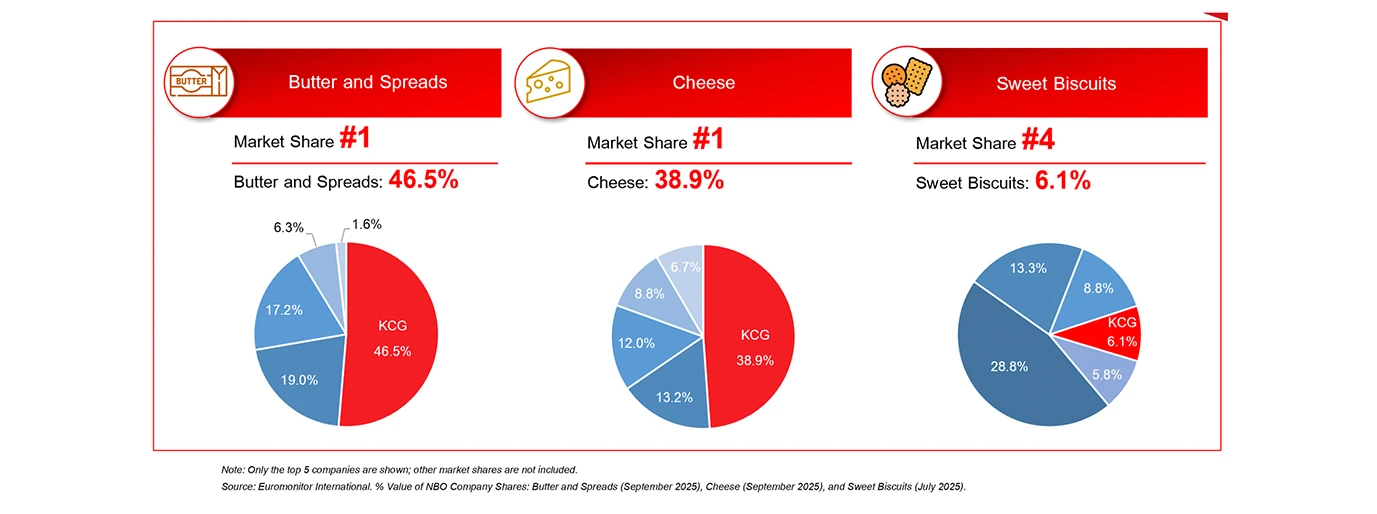

Answer The Company is the market leader in both the butter and cheese product categories. Its Butter and Spreads products hold the No. 1 market share at 46.5%, while its Cheese products hold the No. 1 market share at 38.9%. For Sweet Biscuits, the Company also ranks No. 4 with a market share of 6.1%.

Answer The market share data reported by the Company in 2021 were based on a custom report prepared by Euromonitor International, covering both B2B and B2C markets. In contrast, the 2025 market share data cover B2C markets only. Additionally, the product category classifications differ between the two reports. For example, in 2021, the data covered only the Butter market, whereas in 2025, it covers the Butter and Spreads market. Similarly, Biscuits data in 2021 reflected the Plain Biscuits segment (a subcategory of Sweet Biscuits), while in 2025, the data cover the overall Sweet Biscuits market.

Answer Regarding the Thailand–European Free Trade Association (EFTA) Free Trade Agreement, which involves four member countries — Switzerland, Norway, Iceland, and Liechtenstein — the negotiations are expected to take some time to conclude. Tariff reductions will be implemented gradually and will not immediately drop to 0%.

The Company does not expect the FTA with Europe to place it at a competitive disadvantage. As a leader in the dairy products industry, the Company operates its own high-standard cold-chain logistics transportation system, which enhances its ability to form potential partnerships with European companies. In addition, the Company has already prepared by developing products using raw materials sourced from Europe. Products made from European raw materials offer distinctive taste profiles compared to those sourced from Australia and New Zealand. The Company can also expand its imports of European products beyond its current portfolio, providing a wider range of product offerings and potentially benefiting from lower raw material and product costs in the future.

Answer Following the U.S. Supreme Court’s ruling, tariff rates have been temporarily adjusted to a uniform level of 15% for all countries for a period of 150 days while the U.S. Department of Commerce prepares revised trade measures. During this period, ongoing negotiations between Thailand and the United States are expected to continue in order to monitor potential policy developments, particularly as the United States continues to maintain a trade deficit with Thailand, which may lead to tariff increases on certain product categories. However, regarding prior discussions on tariff reductions and market access for U.S. products conducted before the Supreme Court’s ruling, Thailand may need to lower import tariffs on a wide range of U.S. goods. This development could create opportunities for the Company to increase imports of raw materials or finished products from the United States, provided that reduced import tariffs result in commercially viable cost structures. Such changes would enhance sourcing flexibility and broaden the Company’s access to competitively priced materials and products in the market.