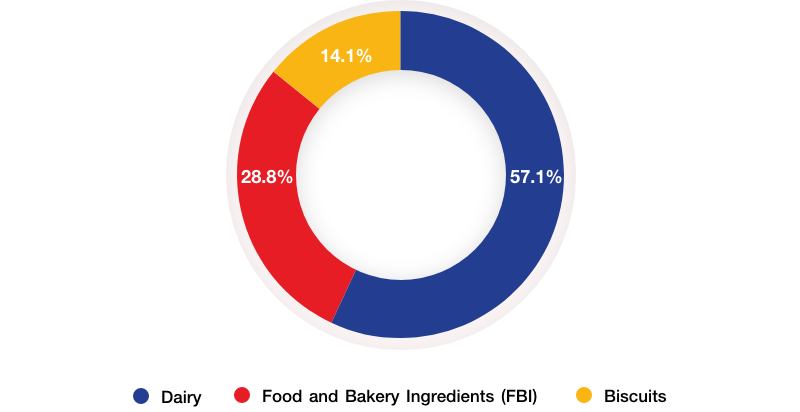

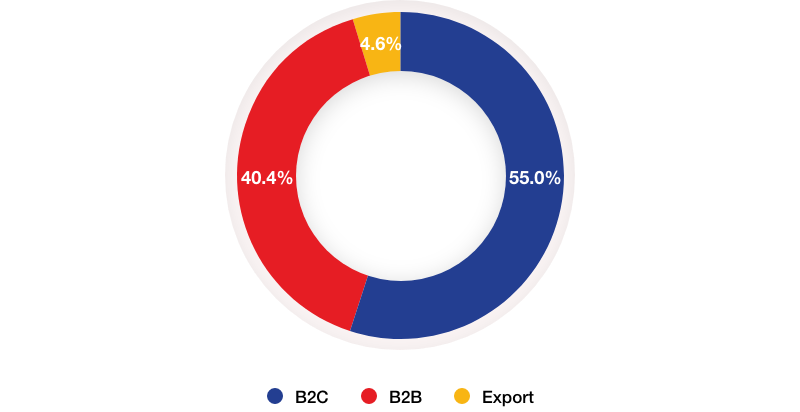

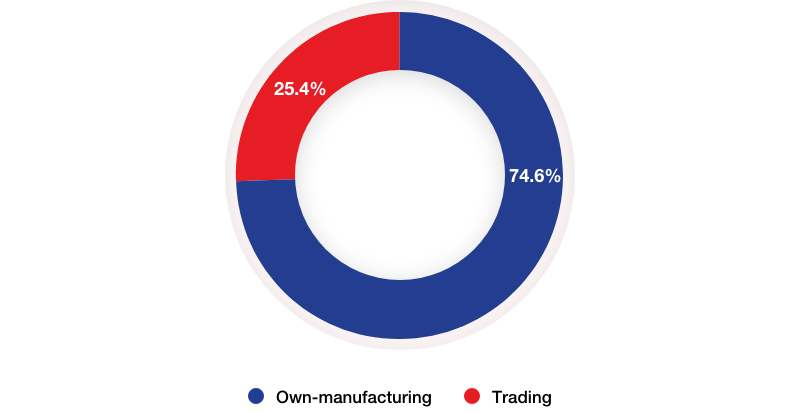

Answer The Company's 2023 sales by product category, by sales channel, and by operation are as follows:

Answer The Company’s 2023 %SG&A to Sales was 24.1%, slightly increased from 24.0% in 2022 mainly due to IPO expenses preparing before listing on the stock exchange of Thailand, while there was a reversal of stock provisions in Q4/2022. However, the Company targets to gradually reduce %SG&A to Sales every year from adopting more technology and digital transformation in every department to help improve the work process to be more accurate and faster in every department, as well as reducing work redundancy, which will result in increased operational efficiency and productivity while reducing operating expenses throughout the supply chain, covering purchasing plans for raw materials and inventory management that are in line with demand planning, production, sales, and support departments. In addition, the Company’s distribution center and warehouse, KCG Logistics Park, which will be partly in use by the end of Q1/2024 and fully operational in the second half of the year, will add storage space, increase inventory management efficiency, and significantly reduce the external warehouse rental costs.

Answer In 2023, raw material costs account for approximately 52.3% of the Company's total GOGS. The main raw materials include butter oil (or Anhydrous Milk Fat), cheeses, palm oil, wheat flour, powdered milk, and sugar, etc.

In 2022, the overall cost of raw materials increased throughout the whole year due to the shortage of raw materials in the world market, the conflict between Russia and Ukraine, the depreciation of the Thai baht, and the increase in energy and transportation costs.

However, from the beginning of 2023, the cost of raw materials started to stabilize and decrease, resulting in the Company's gradual increase of gross profit margin in 2023, quarter by quarter. The movement of the overall cost of raw materials in 2023 has returned to normal, as it did not increase as sharply as in 2022. The not-too-volatile cost of raw materials will benefit the Company’s management. The Company’s gross profit margin in 2023 has returned to normal levels at 30.0%, increased from 28.7% in 2022.

In 2024, the average overall cost of raw materials tends to be relatively stable compared to 2023. Meanwhile, the Company plans to continuously upgrade machinery and improve production processes to increase production efficiency. The Company also plans for SKU rationalization, while production capacity utilization tends to slightly expand in 2024; thus, the Company expects that gross profit margins will continue to slightly improve in 2024.

Answer In 2023, sugar costs accounted for only approximately 0.8% of the Company's total GOGS. In addition, the Company can reformulate raw materials, which will help partially manage production costs. Thus, the impact of the higher sugar prices is quite insignificant to the Company.

Answer The Company purchases in foreign currencies approximately 50% of COGS. However, the Company meticulously manages exchange rates and hedges the foreign exchange rates by buying forward contracts. The Company also has a foreign currency deposit account (Foreign Currency Deposit or FCD), which will help reduce the impact of exchange rate fluctuations.

Answer The Company has strong and well-known products that have been trusted by consumers for a long time. The Company also has a flexible value chain, allowing the Company to create new products for customers and promptly meet customer needs from the following components.

- Production plants certified by international standards for food industry quality and standards, such as GHP (Good Hygiene Practice), HACCP, ISO9001: 2015, Halal and Hal-Q.

- Various distribution channels throughout Thailand, including Business-to-Business (B2B), Business-to-Customer (B2C), online, and exports to 15 countries.

- Efficient logistics including temperature-controlled transportation, which is very important to maintain the freshness and quality of the products.

- Innovation excellence under KCG Excellence Center, which focuses on research, development, and innovation for new product development. The Company is also fully equipped with laboratory, equipment, technology, and personnel such as the RDI (Research Development and Innovation)/ Professional Chefs of the Company that help develop delightful recipes/ Sales and marketing that understand customer needs, which enhances the Company to quickly respond to the needs of both B2C and B2B customers, supported by the Company’s ability to create new menus that keeps up with consumer trends that change quickly, ability to provide solutions to B2B customers starting from creating menu, developing specific formulas for each customer, adjusting the production formulation, controlling production quality in the commercial scale, and efficiently managing the optimal production costs.

Answer Under the FTA, import tariffs on dairy products from Australia and New Zealand have been gradually zero for several years. All the remaining products will be reduced to zero tariffs in early 2025, such as ready-to-drink fresh milk, skimmed milk powder, and whipping cream. Overall, the situation should be beneficial to the Company since the Company can switch some products from manufacturing to importing instead in the future if the cost of importing is better.

As for the FTA with Europe, the Company expects that it should take at least another 3-5 years. However, the Company considers that the FTA with Europe will not cause the Company to a disadvantageous situation since the Company has been preparing to develop products made from raw materials from Europe. The taste of products using raw materials from Europe is different from raw materials from Australia and New Zealand. The Company can also import more trading goods from Europe more than we currently do.

Answer The Company is the market leader in both butter and cheese product categories, with the No. 1 market share for butter products at 55.0% and the No. 1 market share for cheese products at 31.6%. The Company also positions a top 5 market share for FBI and biscuits. (Based on the 2021 market share report by Euromonitor.) The Company has a variety of products, with approximately 2,100 SKUs, covering both the premium market, standard market, and economical market.

Answer Compared to neighboring countries, Thailand still has a lower consumption rate of cheese and butter, thus there is still an opportunity for expansion. In the past 5 years (2017-2022) sales of the Company's butter and cheese products have been increasing at the higher rates than the average growth rate of the domestic industry. The Company, as a leader in the butter and cheese market with a long-standing reputation and reliability for customers and consumers has readiness in terms of technology, personnel, and distribution channels nationwide, driving the Company the ability to create new products that promptly respond to market changes, create new demand and consumption in new ways with satisfying quality and taste for consumers at competitive prices to help drive the Company's sales growth to continue in the future. In addition, the Company has set a goal of sales growth from higher exports and M&A opportunities by seeking opportunities to invest in businesses throughout the supply chain, from upstream, midstream, and downstream businesses, to create an advantage and help enhance the Company's strengths in the future.

Answer The Company set its sales target in 2024 to grow by approximately 2 digits, focusing on products with high growth in consumer demand, sales growth from top customers in both B2B and B2C, online sales, export sales, new product launches, etc. The support will come from the continued recovery of the tourism sector, the expansion of domestic consumption, and the recovery of the export of goods, which will remain the main economic drivers of Thailand in 2024.